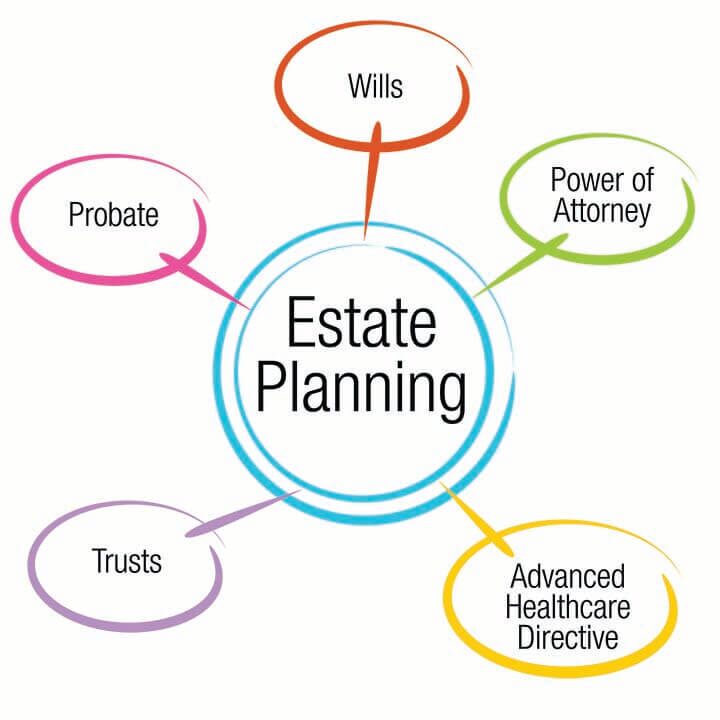

Despite the importance of estate planning, not everyone takes the time to make an appointment with an estate planning attorney and get it done, according to a recent article from Think Advisor, “6 Trust and Will Considerations That Can’t Wait.” Having an estate plan, including a power of attorney for yourself or an older family member is necessary to avoid a more contentious and expensive alternative: guardianship.

If an elderly family member is showing signs of dementia, the power of attorney needs to be done as soon as possible. Capacity doesn’t get better over time, only worse, and once someone is fully incapacitated, the only option is guardianship.

Wills aren’t just for wealthy people. Anyone with even a moderate estate needs a will. Young people often claim they don’t need a will because of their age. However, young and old people die unexpectedly.

Putting a will in place is particularly important for people who want to leave assets to their “chosen” family, those who may be outside the traditional nuclear family but who are for all intents and purposes, their family. Without the benefit of marriage or kinship, chosen family members do not have any legal right to inherit and will not be considered in any property distribution.

Having a will saves heirs from pain and confusion. If you don’t have a will, the court will make decisions for property distribution and guardianship for any minor children according to the laws of the state, which may not be what you had in mind.

Planning for incapacity is part of an estate plan. Designating a Medical Power of Attorney, Financial Power of Authority and HIPAA Authorization giving a trusted person access to medical records and treatment decisions are best done before there’s an emergency.

Guardianship is not something most people want to deal with, and planning can avoid it. Guardianship at its essence is a legal process effectively stripping a person of the right to act on their behalf and must be approved by a court.

It is often required when the loved one is unable to act responsibly or is undermining their family’s ability to act in their best interest under the power of attorney. However, there are many legal landmines in guardianship. The legal process can become contentious, especially if family dynamics are toxic.

Advance planning saves time, money and heartache. The Power of Attorney gives the person named as agent the right to take care of legal and financial matters in the event they can no longer do so for themselves. An estate planning attorney can create a power of attorney to meet your specific needs, either as broad or as narrow as desired.

Reference: Think Advisor (March 2, 2023) “6 Trust and Will Considerations That Can’t Wait”