What are the Most Common Estate Planning Mistakes?

With apologies to poet Robert Burns, the best-laid estate plans of women and men sometimes go awry.

Johnson Law Firm

With apologies to poet Robert Burns, the best-laid estate plans of women and men sometimes go awry.

Preparing for an estate sale can be a difficult and emotionally challenging task.

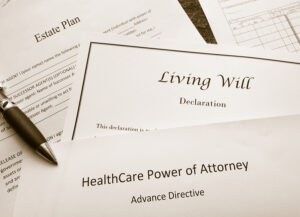

As a review of terms, a will is a legal document that specifies how a person’s estate should be handled only after that person’s death. A living will has nothing to do with how your “things” like property, money, jewelry, etc. are to be distributed. Unlike a will, it is, in fact, a document that comes into play while you’re still alive.

Whether you drew up a will recently or years ago, keep in mind it’s generally not something you can set and forget.

Part of being a responsible homeowner is having a proper estate plan in place. After all, considering the home is generally the largest asset most people own, it’s prudent to ensure this asset is passed to the people you wish to leave it to.

For young professionals finding their way in the world and just beginning the journey of building wealth, death can seem like a far-off abstraction. However, the cold reality is that no one ever knows what’s around the corner — health problems and freak accidents can happen at virtually any time.

The rise in the stock market over the past several years, teamed with the passage of the SECURE Act two years ago and the scheduled 50% reduction in the size of the federal estate tax exemption four years from now, has resulted in a renewed interest in estate planning for IRA and 401k accounts owned by married couples.

Based on a recent survey by the American Pet Products Association, as of 2020, 70% of households in the U.S. have pets—about 90.5 million households.

This is an important question to ask, because the answer could tell you whether you need to worry about estate taxes, beneficiary issues or probate concerns.

In general, the best reason to establish a charitable trust, is if you would like to create a long-standing form of charitable giving.

Posted on