Can Unequal Inheritances Be Fair?

The important thing to acknowledge is that the emotions behind the reasons are not trivial, but are important and should not be dismissed or minimized.

Johnson Law Firm

The important thing to acknowledge is that the emotions behind the reasons are not trivial, but are important and should not be dismissed or minimized.

Check out these English-speaking options for retirement abroad.

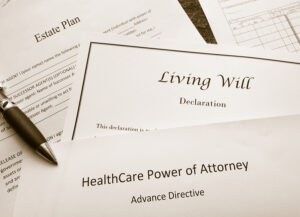

A living will is a legal document expressing your wishes on receiving or declining medical care or life-sustaining treatments should you become terminally ill or injured and unable to communicate those decisions for yourself.

A qualified terminable interest property (QTIP) trust allows an individual, called the grantor, to leave assets for a surviving spouse and determine how the trust’s assets are split up after the surviving spouse dies.

As retirement nears, you may be wondering when to start taking Social Security payments. These benefits are primarily based on your earnings during your working years and your age when you start receiving benefits.

The new Federal Estate tax limit (above which Federal estate taxes will be payable) is $11,200,000.00 per person. Yes, most of us will not hit that limit, but 19 of the 50 states, Illinois included, impose an estate tax of their own ranging from .25% to almost 20% of your estate.

One sure-fire way your clients can reduce the size of their taxable estate is to give gifts to loved ones while they’re still alive. But when are ‘deathbed gifts’ considered to be complete for estate and gift tax purposes?

Does a person need a Power of Attorney document if that person already has a Last Will and Testament (‘Will’)? It is a good question.

For all the pain and disruption caused by COVID-19, at least one benefit appears to have come out of the pandemic for seniors: Their confidence about aging in place has soared!

A trust is an estate planning tool that you may consider using if you want to go beyond drafting a last will and testament.

Antida MacedoneApril 28, 2023