Having a will is especially important if you have young children, says FedWeek’s recent article entitled “Estate Planning Doesn’t Stop with Making a Will.” In your will, you can nominate guardians, who would raise your children in the event neither you nor your spouse is able to do so.

When designating a guardian, try to be practical.

Remember, your closest relatives—like your brother and his wife—may not necessarily be the best choice.

And keep in mind that you’re acting in the best interests of your children.

Be sure to obtain the consent of your guardians before nominating them in your will.

Also make sure there’s sufficient life insurance in place, so the guardians can comfortably afford to raise your children.

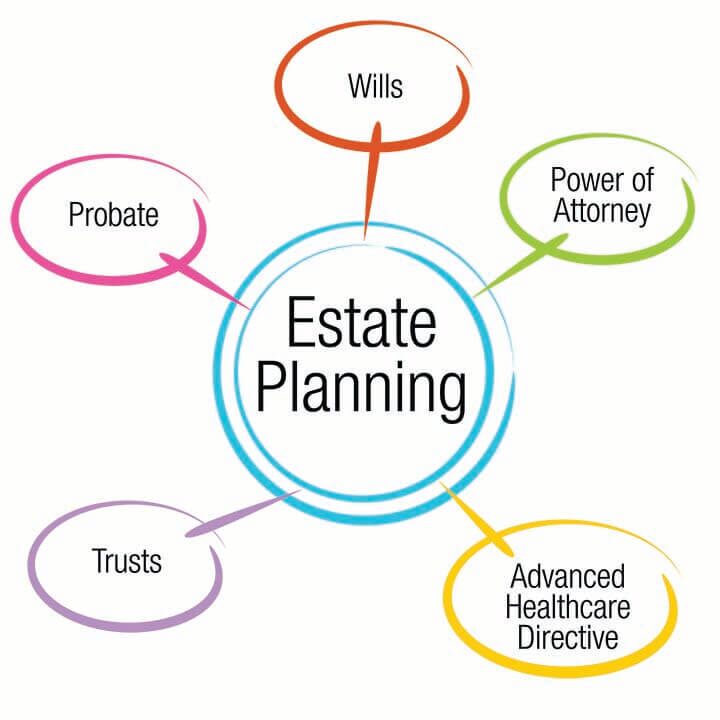

Your estate planning isn’t complete at this point. Here are some of the other components to consider:

- Placing assets in Trust will help your heirs avoid the hassle and expense of probate.

- Power of Attorney. This lets a person you name act on your behalf. A “durable” power will remain in effect, even if you become incompetent.

- Life insurance, retirement accounts and payable-on-death bank accounts will pass to the people you designate on beneficiary forms and won’t pass through probate.

- Health care proxy. This authorizes a designated agent to make medical decisions for you, if you can’t make them yourself.

- Living will. This document says whether you want life-sustaining efforts at life’s end.

Be sure to review all of these documents every few years to make certain they’re up to date and reflect your current wishes.

Reference: FedWeek (Dec. 28, 2022) “Estate Planning Doesn’t Stop with Making a Will”